Calamity or normality?

The end of an ultra-low interest rate era in housing

The Bank of England (BoE) raised Bank Rate by 0.75% to 3% on 3rd November, which was the biggest increase since 1989, and the eighth consecutive hike since December 2021.

This also brought Bank Rate to the highest level since the global financial crisis in 2008.

Source: Bank of England

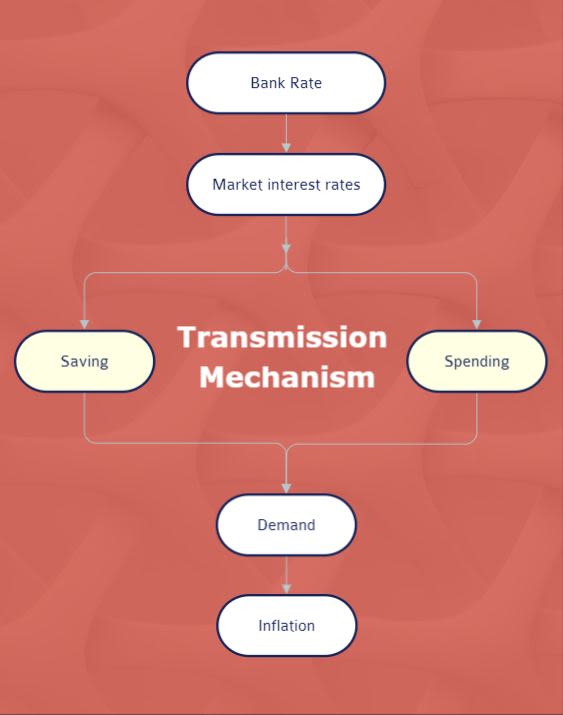

Bank Rate is essentially the base rate of the BoE that influences economic activity and inflation via the transmission mechanism of monetary policy.

Changes in Bank Rate affects market interest rates, including borrowing costs such as mortgage rates, and investment returns such as bank deposit rates.

Higher interest rates tend to encourage savings and discourage spending, lowering the demand for goods and services, which in turn dampen inflationary pressure.

The escalating inflation pressure in the UK was one of the key reasons for the BoE to raise Bank Rate, as its Monetary Policy Committee (MPC) has the mandate to keep inflation within the target level of 2% based on the Consumer Prices Index (CPI).

CPI saw a year-on-year increase of 11.1% in October, up from 10.1% in September and 9.9% in August, way above the 2% target level.

Source: Office for National Statistics

Another important indicator of inflation is the Consumer Prices Index including owner occupiers’ housing costs (CPIH), which saw a year-on-year increase of 9.6% in October, up from 8.8% in September and 8.6% in August.

Source: Office for National Statistics

Mini-budget calamity

There is also a strong link between interest rates and public sector deficit.

As the government plans to spend more and lower taxes, it generally needs to borrow more, that the market will demand higher government bond yields to compensate for the higher default risk.

Higher net government expenditure will contribute to higher inflation, too.

The mini-budget suggested by former prime minister Liz Truss and former chancellor Kwasi Kwarteng on 23rd September, raised concerns over fiscal sustainability, which further heightened market expectations of inflation and future rate hikes to fund government debt.

It entailed £45 billion of unfunded tax cuts and ramped up government borrowing, without an independent assessment from the Office for Budget Responsibility (OBR).

On the back of widespread criticism, the Truss government scrapped the plan to cut the 45p top rate of income tax.

Truss also sacked Kwarteng and appointed Jeremy Hunt as the new chancellor on 14th October, U-turning on most parts of the mini-budget.

Kwarteng wrote in a letter that Truss had asked him to stand aside as her Chancellor and that he had accepted.

After just 44 days in office, Truss was replaced by Rishi Sunak on 25th October.

Liz Truss and Kwasi Kwarteng discussing their growth plan ahead of a fiscal statement to the House of Commons on 23rd September in 10 Downing Street (Image credit: Flickr / Rory Arnold CC BY-NC-ND 2.0)

Liz Truss and Kwasi Kwarteng discussing their growth plan ahead of a fiscal statement to the House of Commons on 23rd September in 10 Downing Street (Image credit: Flickr / Rory Arnold CC BY-NC-ND 2.0)

Rishi Sunak and Jeremy Hunt in the Cabinet Room in 10 Downing Street (Image credit: Flickr / Simon Walker CC BY-NC-ND 2.0)

Rishi Sunak and Jeremy Hunt in the Cabinet Room in 10 Downing Street (Image credit: Flickr / Simon Walker CC BY-NC-ND 2.0)

Back to normality

The change in government somewhat restored some confidence in fiscal policy, and the BoE signalled a more dovish outlook for interest rates in the latest MPC meeting on 3rd November.

That said, interest rates are unlikely to go back to the ultra-low levels seen in the aftermath of the 2008 financial crisis when central banks conducted quantitative easing.

Andrew Bailey, Governor of the BoE since 2020, said after the rate announcement on 3rd November: "Further increases in Bank Rate might be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets."

He also said: "There has been a questioning of UK policy.

"That will have some lasting effect.

"We’ll have to work very hard to put that in the past."

Jeremy Hunt holding a video conference call with Andrew Bailey from his offices in the Treasury (Image credit: Flickr / Simon Walker CC BY-NC-ND 2.0)

Jeremy Hunt holding a video conference call with Andrew Bailey from his offices in the Treasury (Image credit: Flickr / Simon Walker CC BY-NC-ND 2.0)

Lifting rates from near zero level and reversing quantitative easing may mean a return to the old normal - but the pace of doing so appeared to have caught the public by surprise.

The higher Bank Rate translated into higher mortgage rates offered by lenders, and mortgage payments are one of the biggest expenses for many households.

UK Finance is a financial services industry body, representing around 300 firms providing finance, banking, markets and payments-related services in or from the UK.

A UK Finance spokesperson said: "Lenders stand ready to help customers who might be struggling with their mortgage payments, with a range of tailored support available.

"Anyone who is concerned about their finances should contact their lender as soon as possible to discuss the options available to help.”

How are homeowners and renters coping?

Dan Mac Hale, 37, homeowner, Shoreditch, said: “The budget the government released is completely wrong.

“It benefits the wrong people – it benefits the people who are already very well-off.

"The mini-budget is completely upside-down and it itself is causing inflation.

“I was quite lucky that I got my mortgage seven years ago when the rates were quite reasonable.”

His mortgage rate was fixed at 1.2% back then, and now he still had another 5-year fixed rate at 1.6% that was still lower than the current rate.

He added that if he was to move now, he would have to pay 4% if not higher with the rates going up, and possibly even 6-7%, which would make repayment impossible.

Another homeowner, Hector Fernandez, 32, tax lawyer, Hampshire, also had a 5-year fixed rate mortgage so the latest rate hikes had not affected him directly.

Yet he expressed he was uncertain about the future.

He also said it had become difficult for some of his friends and colleagues who needed to remortgage or get a new home.

He said: "Some have to pay a few hundreds more per month.

"Some cannot afford a new home because the loan is more expensive than just six months before.

"Now the cost of living is very high."

When asked about future plans of homebuying, Federico Gorinati, 32, Rushmoor, said: "I wouldn't put myself in such a position right now.

"There is no way that buying a house is attractive to me at the moment."

Private sector rents, however, also shot up, and Gorinati said his rent increased by more than 10% this year.

Indeed, according to Rightmove, national average asking rents outside London hit a new record of £1,162 per calendar month, while average London rents saw the biggest annual jump of 16.1% to £2,343 in Q3 2022.

Rightmove said the jump in mortgage rates could mean some potential buyers stay renting for longer, which would place further strain on the number of available homes.

What do you think?

Interest rates have wide-ranging impacts on the economy, with housing being one of the hardest hit sectors.

What do you think Bank Rate would be in 12 months’ time?

How does the change in rates affect your housing situation and future planning?

Let me know by participating in the poll below.

Additional image credits:

Coins background from Stockvault CC0 1.0

Wooden house background from Flickr CC BY 2.0